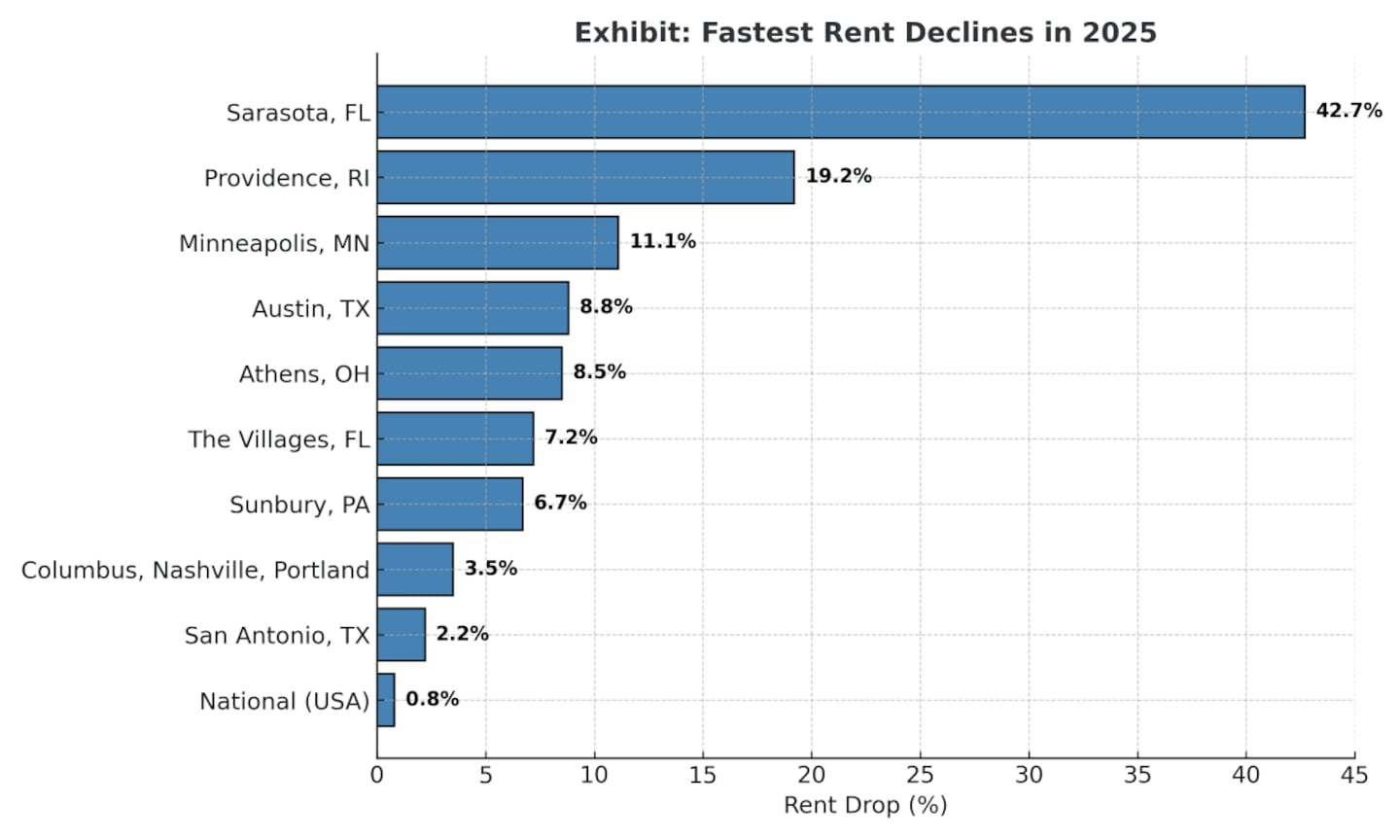

Where rent is dropping fastest in 2025

After years of relentless rent hikes across the United States, 2025 is finally bringing relief to renters in many markets. A surge in new apartment construction, coupled with pro-housing reforms in select cities, is pushing vacancy rates higher and driving rental prices down at a pace not seen in more than a decade. From booming metros like Austin and Minneapolis to smaller markets such as Sarasota and Athens, rents are falling sharply—sometimes by double digits—reshaping the housing affordability landscape. House of Leon shares a closer look at where rent is dropping fastest in 2025, and what's fueling the trend.

1. Sarasota, Florida — the standout case

Sarasota takes the top spot in rent declines across the U.S.—with average monthly rents collapsing a staggering 42.67% from $3,290 in January 2024 to $1,886 by January 2025. This shift is widely credited to proactive pro‑housing policies, including zoning deregulation, higher‑density allowances, and a $40 million investment toward affordable housing projects. (Source: Reason)

2. Providence, Rhode Island — nearly 20% drop

Next on the list is Providence, where rents fell 19.22% year-over-year, dropping from $2,513 to $2,030. Similar to Sarasota, the city eased restrictions on housing development, streamlined permitting, and encouraged repurposing existing structures, contributing to this significant decline. (Source: Reason)

3. Minneapolis, Minnesota — double-digit descent

Minneapolis experienced an 11.14% drop in rent—placing it among the cities with the steepest declines. This supports broader findings that pro-housing changes, such as zoning reform, are helping suppress rent hikes. (Source: Planetizin)

4. Austin, Texas — almost 9% drop in asking rents

In major metro markets, Austin saw the most dramatic rent declines: an 8.8% year-over-year net drop in median asking rent, landing at $1,385 in May 2025—the lowest since February 2021. This trend is directly tied to an explosion in multifamily housing construction, with Austin approving 64.5 units per 10,000 people—the highest rate nationwide. (Source: Redfin)

5. Other beneficiaries of slack rent:

- Columbus, OH: –3.5%

- Nashville, TN: –3.4%

- Portland, OR: –3.4%

- San Antonio, TX: Though not as dramatic as the others, San Antonio posted a 2.2% year-over-year rent decline in May 2025, providing some relief amid broader inflation pressures.

(Source: Redfin, San Antonio Express)

6. Smaller markets with surprising drops

A comprehensive review by BiggerPockets identified numerous smaller cities experiencing steep rent declines in 2025:

- Athens, OH: –8.51% (average rent: $802)

- The Villages, FL: –7.21%

- Sunbury, PA: –6.73%

- Others include Pullman, WA; Naples, FL; Sevierville, TN; Key West, FL; among several more.

(Source: Bigger Pockets)

7. Broader trends: national slowdown in rent growth

- Apartment List's July data shows a 0.8% year-over-year decrease, with the national median rent at $1,402 and an historic-high vacancy rate of 7.1%, thanks to a massive supply of new multifamily units.

- Similarly, Zillow projects a continued slowdown in rent growth: single-family growth slowing to around 2.7% and multifamily around 1.3% for 2025—though this is still growth, it's a notable deceleration compared to recent years.

(Source: Nerd Wallet)

House of Leon

Why Is This Happening?

- Pro-Housing Reforms

Cities like Sarasota, Providence, Minneapolis, and Austin adopted land-use deregulation and streamlined zoning, unlocking housing supply and pressuring rents to fall. - Construction Boom & Vacancy Climb

Record numbers of new multifamily units hit the market in 2024–2025, driving up vacancy rates and weakening landlords' pricing power. - Seasonal & Macro Shifts

While rents typically spike during moving seasons, 2025 winter and spring showed unusual softness. Economic uncertainty and cooling markets further dampened rent growth.

(Source: Reason, Redfin, Bigger Pockets, Nerd Wallet)

Summary: Where Rent Is Dropping Fastest in 2025

- Top Outlier: Sarasota, FL (–42.7%)

- Major Metro Drops: Providence, Minneapolis, Austin (–9% to –19%)

- Other Notable Declines: Smaller markets like Athens and Sunbury (–6% to –8%)

- National Trend: Modest overall decline (~–0.8%), driven by supply surge

This story was produced by House of Leon and reviewed and distributed by Stacker.